According to official data from the Miami Association of Realtors, Argentinians were the top foreign buyers in South Florida during 2024. The trend reflects a well-established preference for safeguarding wealth through real estate in a market that offers stability, value growth, and sustained demand.

2024 closed with a telling figure: international buyers invested $3.1 billion in residential properties across South Florida, according to the Miami Association of Realtors’ annual report published in February 2025.

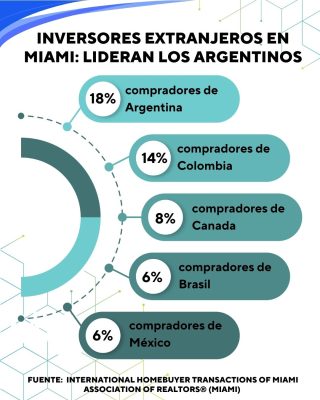

Argentinians topped the list, accounting for 18% of all international purchases in the region—and an even higher share (21%) within Miami-Dade County. This leading position places Argentina ahead of other strong market players like Colombia (14%), Canada (8%), Venezuela (6%), Mexico (5%), and Brazil.

Why Does Miami Remain the Preferred Destination?

This preference is not new, but it continues to deepen year after year. High-net-worth Argentine buyers see South Florida—especially Miami—as an unmatched combination of legal security, stable environment, cultural vibrancy, and, most importantly, an asset that appreciates over time.

Miami is not just a vibrant city; it is also an economic and legal haven. Its real estate market offers a wide range of options, from units with immediate rental potential to those intended for future personal or family use, including relocation plans.

Miami-Dade: The Epicenter of Argentine Investment

Although South Florida encompasses several counties, the MIAMI REALTORS® report confirms that Miami-Dade remains the top choice among Argentine buyers, who account for more than one in five foreign purchases in the area.

Their profile is clear: they look for well-located apartments with solid property management and resale value. The idea of a “haven” coexists with a long-term vision, as many of these purchases are made for children who are studying in or planning to move to the U.S.

How They Buy and What They Choose

The report offers insights into the Argentine buyer profile:

- 66% of purchases were made in cash, a figure 16 percentage points above the national average. This method speeds up transactions and bypasses financial barriers.

- The average price paid by Argentinians was $470,500, lower than that of Mexican ($625,000) or Brazilian ($607,000) buyers, yet still within a range that provides access to quality properties with high rental or appreciation potential.

- 56% of international purchases were condominiums, a preference that triples the national average (23%) and shows a clear tendency toward low-maintenance properties ideal for flexible or short-term rentals.

Motivations Beyond Economics

What drives an Argentine buyer to invest in Miami? The motivations are diverse, but all center on a common goal: asset protection, diversification, and long-term planning.

- In a context of local macroeconomic instability, Florida real estate stands out as a reliable asset—offering legal security, steady appreciation, and liquidity.

- Miami’s cultural and linguistic familiarity makes the entire process easier, from choosing a neighborhood to handling post-sale management.

- Many buyers take a long-term view: a property that generates income today and may become a future home for children or grandchildren. In that sense, the investment is financial, emotional, and strategic.

While the global context may fluctuate—with interest rates, inflation, or financial markets—Miami’s appeal as a place to live, invest, or safeguard capital remains strong. In that scenario, Argentinians are no longer just a presence—they’re leading players.

Considering Investing in Miami

At Swann, we closely track market trends and support our clients at every stage—from property search to acquisition and management. Reach out if you’d like to explore real opportunities in Miami tailored to your investment profile.